Ah, the Benner Cycle — a financial fjord of predictability in an ocean of economic uncertainty. But let’s dive a bit deeper, shall we? With a sprinkle of Scandinavian humor.

🎧 Experience this article in the digital voice of Henrik Yllemo

The Benner Cycle: A Saga of Economic Seers

Samuel Benner, the original Odin of economic forecasting, might have been a farmer, but when the Panic of 1873 hit, he didn’t just sit around and leek his wounds. He took to the numbers like a duck to water—or should we say, like a Finn to a sauna—and crafted a cycle that’s been as reliable as a Volvo.

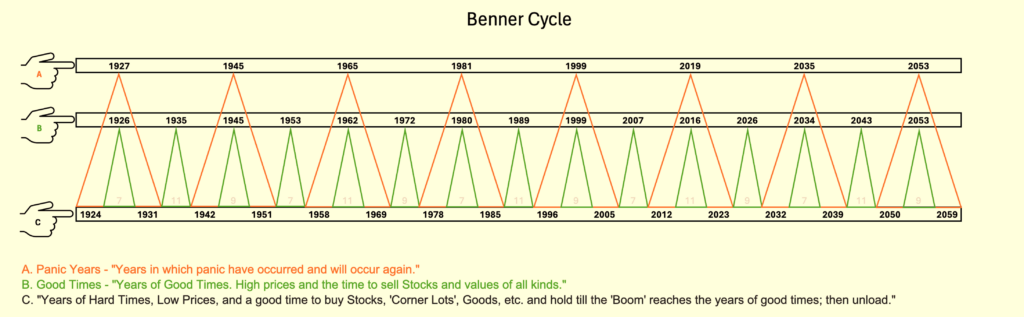

The Benner Cycle is a chart depicting market cycles between the years 1924 to 2059. The chart was originally published by Samuel Benner in his 1884 book, “Benner’s Prophecies of Future Ups and Downs in Prices”. The chart marks three phases of market cycles: Panic Years, Good Times, and Hard Times. Panic Years are years when the market panicked, either buying or selling a stock irrationally until its price skyrocketed or plummeted beyond anyone’s wildest expectations. Good Times are years Benner identified as times of high prices and the best time to sell stocks, values, and assets of all kinds. Hard Times are years when Benner recommends buying stocks, goods, and assets and holding them until the “boom” years of good times, then unload.

Benner looked deeper into these cycles and found an eleven-year cycle in corn and pig prices with peaks every 5/6 years. This matches the 11-year solar cycle. Benner considered that this solar cycle affects the harvest, which affects revenue, supply/demand, and price. The Benner cycle also uses a 27-year cycle in pig iron prices with low prices every 11, 9, 7 years and peaks coming in at 8, 9, 10 years.

The Accuracy of the Benner Cycle: Almost as Predictable as Winter in Scandinavia

Benner’s Cycle has been spot-on, like a well-thrown axe in a game of Kubb. It’s had a success rate that would make even the most stoic of Vikings crack a smile. But let’s be honest, predicting the market is like predicting the weather in Scandinavia—if you don’t like it, just wait five minutes, and it’ll change.

AI and the Age of Copilots: The Loki of Predictions?

Enter the age of AI and Copilots, the mischievous Lokis of the financial world. These digital dynamos are shaking up the soothsaying business, crunching numbers at speeds that would make Benner’s horse and plow look like they’re moving backward.

But here’s the twist: AI might just be too good. With machine learning and data analysis, these Copilots could either fine-tune our predictions to near perfection or throw a wrench in the works with their overzealous algorithms, leading us to believe that every year is a “Panic” or a “Good Time.”

A Little Curiosa: When History Repeats Itself, It Likes to Wear Disguises

History does indeed love to repeat itself, but it’s got a wardrobe full of costumes. One day it’s a bull market, the next it’s a bear, and sometimes it’s just a confused chicken crossing the road. The Benner Cycle has been like a trusty almanac, but with AI in the mix, we might need to brace ourselves for some plot twists.

So, as we sail into the future on our longships of ledger lines and balance sheets, let’s remember to keep our helmets on. The seas of finance are choppy, and whether you’re a Viking berserker or a Copilot augmented well watcher, it’s always wise to have a life vest—or at least a diversified portfolio.

And there you have it, a tale of the Benner Cycle, complete with Scandinavian wit and a nod to the AI revolution. Will the Copilots uphold the legacy of Samuel Benner, or will they chart a course for uncharted waters? Only time will tell. But one thing’s for sure: in the land of Vikings and Volvos, the only constant is change, and the only good investment is in laughter. Skål! 🍻